In a recent conversation with one of our Indian business contacts we worried that - according to the latest forecasts of the IMF and renowned economic research institutes – even the Indian economy is expected to be losing steam in 2012.

Upon which our Indian friend drily commented: “so, the Indian economy will grow at a rate of 6% or 7% instead of 9%.”

Our friend’s quip nicely puts the business media’s despondent reporting in perspective: Even as the growth of the world economy is set to come to a halt in the near-term Asia, led by China and India, and to some degree Brazil will continue to forge ahead.

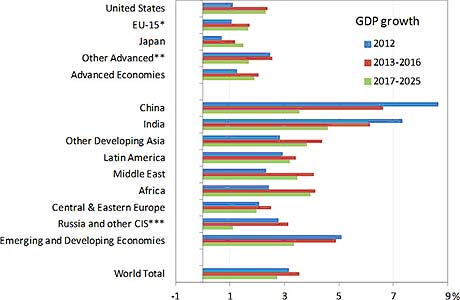

Global Outlook for Growth of Gross Domestic Product, 2012-2025 (IMF-November 2011)

(*EU-15 refers to states that joined the European Union before 2004.

**Other advanced economies include Canada, Switzerland, Norway, Israel, Iceland, Cyprus, Korea, Australia, Taiwan Province of China, Hong Kong, Singapore, New Zealand and Malta.)

By contrast, it seems likely that European and American economies will be stuck in an unsettling slow-growth quagmire for years to come. Corporations that traditionally have depended on the Western markets for growth now will need to embrace the idea of shifting even more of their attention to these emerging markets. It will no longer suffice to sell to India or China form their Chicago, Stuttgart, Milan or Yokohama factory. In order to alleviate the competitive pressures, to be closer to the customer and to save costs companies that are not manufacturing in those countries will need to find ways to supply products “made in India” or “made in China” and companies that already have their own manufacturing in those countries will need to seek deeper and broader manufacturing integration.

The case for India

Over the last twelve months, the Indian Rupee has depreciated nearly 15% against the US Dollar. This has made acquisitions of Indian assets more economical. Correspondingly, products or components made in India for exports are also a lot cheaper. In the same period, the Chinese Yuan has consistently been floating up in US Dollar, Euro or Yen-terms.

Unlike 2008, when the Indian market (and valuations) was at an all time high, the valuation expectations have become a lot more reasonable. At the same time, Indian businesses realize that to survive a tough market they must collaborate with financially sound partners, bring in new technology and sell in newer markets where they have never sold before. There may be a greater degree of flexibility in sellers in considering how to sell their businesses.

According to IMF forecasts, India and China are expected to grow at rates exceeding 7% (see graph above); the US and Europe meanwhile are expected to grow at less than 2%. Even the growth rates of India and China were downgraded by the IMF only in the last 3-4 months from 9+% gdp to ~7% gdp. Firms are still coming to terms with slower growth; our view is that the ones who have been trying to sell since 2008 (sometimes at inflated expectations) will start to show greater flexibility. 2012 it will be a great time to buy companies in India.

There is no doubt that the last 2-3 years have been tough for Indian industrial companies as well. However, as in any tough climate, good companies continue to get stronger as they weed out the competition. There is a chance to partner with the right set of companies in India.

Green field or Buy?

Companies keep asking us for the best course of action; whether they should continue to supply the Indian market out of their base in their home country or set up a local sales office, start their own manufacturing or buy an Indian company. Our response invariably is: “it depends”. Each company may have its own set of issues, its specific relationship with customers, manufacturing specifics etc. A serious long-term involvement in a major low-cost location such as India would almost certainly require some manufacturing in the country. So the question really is reduced to two options: green field vs. acquisition of (investment in) a local company.

Painted with a broad brush some pros and cons of both options can be summarized as follows:

Pros Acquisition Option:

- Takeover of operational company

- Takeover/addition of customers sales network

- Fewer bureaucratic hassles (no building permits etc)

- Employees and well-honed organization in place

- Head-start amounting to years

- Company is run and operated the Indian way (allowing for Indian “cultural” aspects)

Pros Green field Option:

- Lay-out and equipment in line with company’s specific requirements

- Staffing and organizational structure in line with investor’s specifications

The latter item, in particular, often turns out to be a double-edged sword, as it is difficult for foreigners to find the “right employees” in India and to build a working organization patterned after a foreign business model.

As a rule buying a company seems to be more cost-effective, time-saving and more in line with the local customers’ expectations than building a company in the green field.

The question that remains may be: “How do I find the optimal target company in India?”

GGI has a lot of contacts among the industries that we cover in India. We know companies that, currently, are looking for a buyer; we know companies that have given us reason to believe that they might be open to discussions; and we know companies in our industries that to our knowledge are not for sale – but as we constantly are in touch with them, we can ask them any time if and under which circumstances they might change their minds.

If you have any questions about target companies for you in India feel free to give us a call or send us an e-mail.

US/European contact: Hubert Gammer

Email hgammer@gammer.com Phone +1 650-593-2400

Indian/Asian contact: Amit Israni

Email: aisrani@gammer.com Phone: +91 99999 44830

*About Amit Israni:

Amit Israni was most recently Director/Strategy and Research for Rexnord Corporation and previously worked for DaimlerChrysler, Caterpillar and IDEX. He has deployed over $2.5 billion in capital over 25+ M&A transactions and has over 17 years of experience in M&A, Strategy and General Management. He holds an MBA from University of Chicago and BE from Delhi College of Engineering.